Introduction

Chemical Market Overview – January 2025

The chemical market in January 2025 reflected a mix of stability and volatility across key segments, shaped by fluctuating feedstock prices, supply chain dynamics, and seasonal demand variations. Propylene, ethylene, and their derivatives experienced notable price movements, while global economic conditions and geopolitical factors influenced supply availability and market sentiment. The ongoing recovery in industrial production, coupled with shifts in consumer demand, has also played a role in determining price trends and supply chain efficiencies across various chemical sectors.

Propylene and Derivatives

Propylene prices saw a downward adjustment in December 2024, with chemical-grade propylene settling at 37.5 cents per pound and polymer-grade propylene at 39 cents per pound. The decrease was attributed to an oversupply situation, improved steam cracker operations, and weaker demand from polypropylene (PP) markets. Despite steady supply from PHD units, refinery-based propylene production was deprioritized in favor of gasoline output. Derivatives such as propylene oxide experienced price declines due to weaker demand, while propylene glycol prices stabilized following earlier softening, with minor demand surges in food, flavoring, and de-icing applications. Moving into the first quarter of 2025, market analysts expect propylene pricing to remain relatively stable, with potential increases if demand for derivatives strengthens in industrial and consumer applications.

Ethylene and Ethylene Derivatives

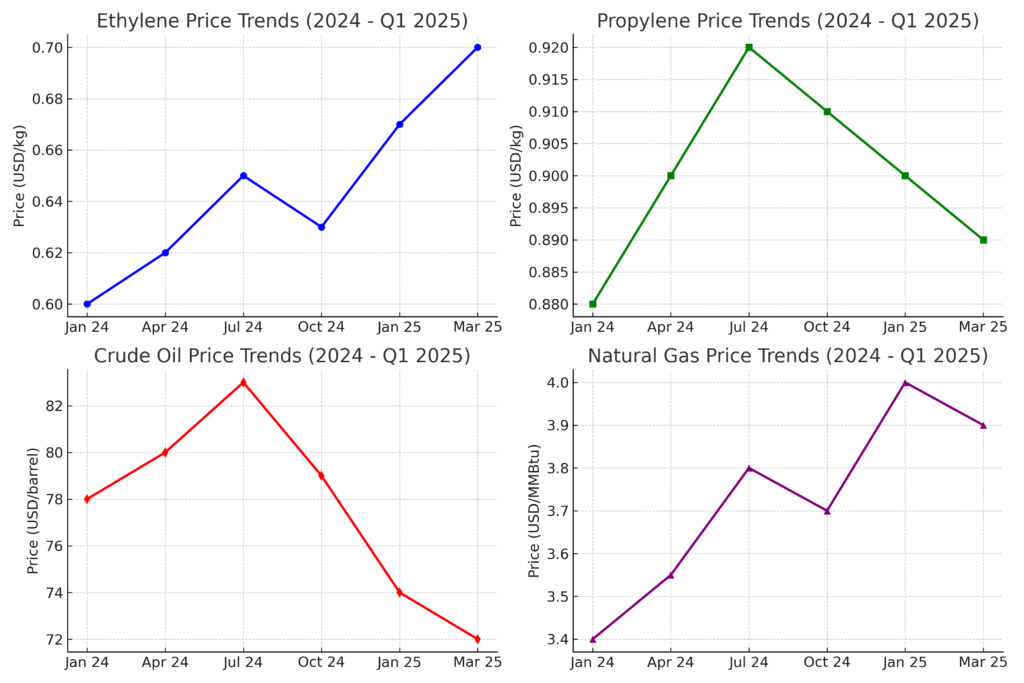

Ethylene contract prices increased by 3.25 cents per pound in December, reaching 34.75 cents per pound, driven by operational challenges and anticipated inventory declines in Q1 2025 due to scheduled maintenance turnarounds. Demand remains strong for ethylene derivatives such as ethylene glycol, surfactants, and polyethylene. Ethylene oxide prices followed an upward trend in response to increased ethylene values, with supply constraints expected in Q1 due to multiple planned maintenance events. The ethylene market’s ability to manage these supply disruptions will be a key factor in determining pricing trends in the months ahead. The strong demand from polyethylene producers and downstream industries could further support pricing momentum, particularly if inventory drawdowns become more pronounced.

Aromatics and Solvents

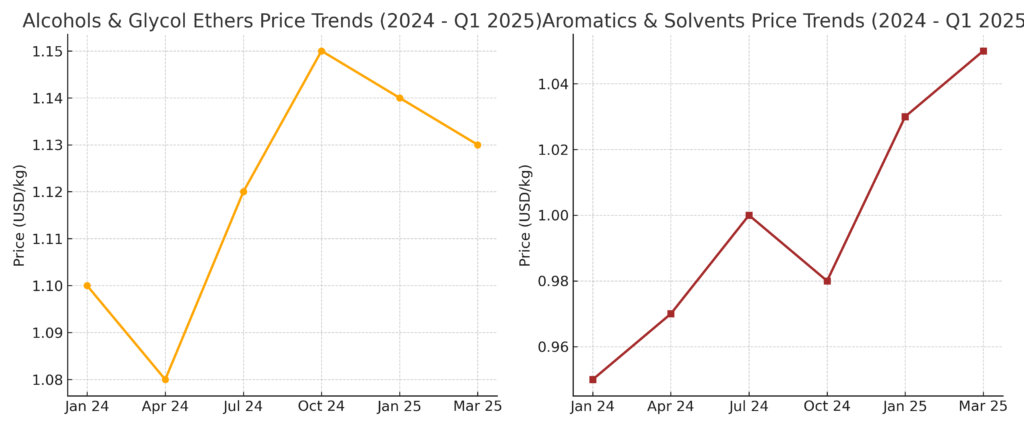

The acetone market remained stable, supported by a balanced supply from both domestic production and imports. While solvent and methyl methacrylate (MMA) demand was steady, weaker construction and automotive industries kept overall demand muted. Benzene prices saw an increase of $0.14 per gallon in January, reaching $3.13 per gallon, contributing to pricing pressures on downstream products such as cumene, phenol, and styrene. The demand outlook for benzene and related derivatives will depend on the pace of recovery in key end-use markets, particularly in the automotive and consumer goods sectors, where economic uncertainty and high interest rates continue to impact purchasing behaviors.

Alcohols and Glycol Ethers

Despite a decline in propylene prices, isopropyl alcohol (IPA) prices remained stable due to sustained demand. P-series glycol ethers maintained a balanced supply with no significant price changes expected in Q1 2025. E-series glycol ethers faced potential tightness due to upcoming maintenance activities and tariff uncertainties, which could push prices higher. With rising global energy costs, some chemical producers are also evaluating alternative feedstock sources, which may introduce further volatility into the glycol ethers market.

Chlorinated Products and Inorganics

The North American chlorine market remained balanced, with seasonal low merchant demand. Notable capacity changes included the planned shutdown of Olin’s 450,000 short-ton chlorine capacity in Freeport, TX, and the announcement of a new 340,000 short-ton facility by PCC Group to supply Chemours in DeLisle, MS. Despite these shifts, the market is expected to remain well-supplied. Caustic soda prices softened slightly due to sluggish end-of-year demand, while sulfuric acid prices remained stable but tight, with regional adjustments balancing supply constraints. The anticipated increase in industrial activity during the spring and summer months could lead to stronger demand for chlorinated intermediates, supporting a more bullish pricing outlook later in the year.

Crude Oil and Energy-Related Chemicals

Crude oil prices climbed to $74 per barrel in early January, driven by Chinese stimulus measures and inventory tightening amid cold weather in North America. Despite this increase, the market fundamentals remained weak. Natural gas contracts started January at $3.43 per MMBtu and briefly exceeded $4.00 due to seasonal winter demand before settling at $3.51. Methanol supply faced disruptions, with a Texas facility resuming production after a month-long outage, while another plant in Equatorial Guinea declared force majeure with no restart timeline. These disruptions have tightened the methanol market, raising concerns about potential shortages if additional production issues arise. The biofuel sector remains a wildcard, with legislative uncertainty surrounding tax credits and renewable fuel mandates adding another layer of complexity to the outlook for methanol and other energy-related chemicals.

Agricultural and Renewable Feedstocks

Palm oil prices edged up by $0.015 per pound, influenced by severe monsoon rains impacting harvests. Fatty alcohols and fatty acids saw price hikes due to increased demand and supply constraints. Soybean oil prices, on the other hand, fell by $0.055 per pound, affected by uncertainty surrounding the U.S. biofuel tax credit policy. The expiration of the biodiesel tax credit at the end of 2024 created uncertainty in biofuel production, impacting demand for tallow-based and soybean oil-based feedstocks. Additionally, the ongoing geopolitical tensions in key agricultural regions could further disrupt global supply chains, influencing pricing trends for vegetable-based feedstocks and related derivatives.

Transportation and Logistics

The transportation sector experienced mixed trends in January. Diesel prices remained stable at $3.49 per gallon, while truckload contract and spot rates were expected to see year-over-year increases by mid-2025. Rail freight rates showed minimal increases following annual negotiations, with Class I rail carriers maintaining stable employment levels. Global vessel schedule reliability improved to 54.8%, the highest level seen in 2024, though congestion at major ports continued to be a challenge. The increasing costs associated with global shipping and transportation may lead to higher landed costs for imported chemicals, further complicating supply chain planning for many market participants.

Outlook for Q1 2025

As the market moves further into Q1 2025, several factors will shape the trajectory of chemical prices and supply chains. Ethylene and propylene markets are expected to remain dynamic due to planned maintenance turnarounds and potential feedstock volatility. Demand for industrial and consumer applications will play a critical role in stabilizing prices across key segments. Additionally, geopolitical risks, tariff uncertainties, and macroeconomic factors such as interest rates and inflation will continue to influence market sentiment and investment decisions. The chemical industry will need to navigate these challenges while remaining agile in response to evolving market conditions, leveraging strategic partnerships and supply chain innovations to mitigate risks and optimize performance.

Overall, the chemical industry enters 2025 with a cautiously optimistic outlook, balancing supply chain resilience with demand recovery across various sectors. While certain headwinds remain, industry players with diversified portfolios and strong logistical capabilities will be well-positioned to capitalize on emerging opportunities throughout the year.

Leave a Reply

Your email address will not be published. Required fields are marked *