Introduction

Inflation has remained one of the most pressing economic issues in the United States, shaping financial markets, consumer behavior, and policy decisions. While inflation is influenced by various factors such as monetary policy, labor market conditions, and global economic events, supply chain resilience plays a significant role in determining price stability. In recent years, supply chain disruptions have contributed to inflationary pressures, highlighting the need for more robust and adaptive supply networks. Understanding the relationship between inflation and supply chain resilience is critical to formulating strategies that ensure economic stability while mitigating price volatility.

Understanding Inflation: Causes and Trends

Inflation, the rate at which prices for goods and services rise, is a natural part of economic cycles. However, excessive or prolonged inflation can erode purchasing power, disrupt financial planning, and create instability in both consumer and business markets.

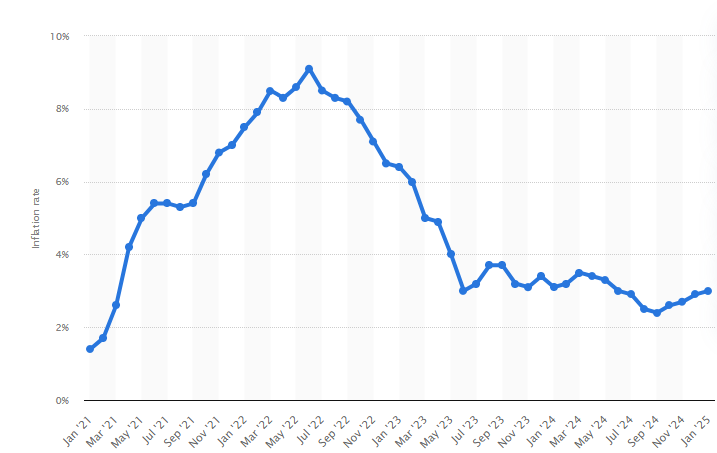

Recent Inflation Trends in the United States

As of February 2025, the U.S. annual inflation rate stood at 2.8%, marking a slight decrease from 3% in January. Consumer prices, particularly in the energy and food sectors, have remained elevated despite the Federal Reserve’s tightening measures. Gasoline prices rose by 1.8%, while food prices continued to show resilience due to supply chain inefficiencies and unpredictable weather patterns affecting agricultural output1.

Egg prices, for example, have surged by 310% since 2005, driven by avian flu outbreaks and supply chain vulnerabilities in poultry production. Other food categories such as meats, poultry, and fish have experienced persistent price hikes, exacerbated by transportation costs and labor shortages2.

The energy sector has also been a major contributor to inflation. Natural gas prices have increased due to colder-than-expected winter conditions, leading to heightened demand and supply constraints. The fluctuating price of crude oil has further fueled cost increases across multiple industries, impacting everything from logistics to manufacturing3.

The Supply Chain’s Role in Inflationary Pressures

Supply chains serve as the backbone of the economy, ensuring that raw materials, intermediate goods, and finished products move efficiently across various industries. When these networks are disrupted, inflationary pressures mount due to increased costs in production, distribution, and storage.

How Supply Chain Disruptions Contribute to Inflation

- Higher Production Costs: Supply chain disruptions, such as port congestion, shortages of raw materials, and transportation bottlenecks, increase the cost of production. These additional expenses are often passed down to consumers in the form of higher prices.

- Reduced Supply and Higher Demand: When supply chains falter, shortages of essential goods emerge. Limited supply combined with sustained or increasing demand leads to price surges, contributing to inflation.

- Increased Transportation and Logistics Costs: Fuel price volatility and disruptions in global shipping routes lead to higher freight costs, which, in turn, elevate the overall cost of goods.

- Labor Market Constraints: A shortage of skilled labor in key sectors such as trucking, warehousing, and manufacturing exacerbates supply chain inefficiencies, leading to delays and increased costs4.

Supply Chain Disruptions During the COVID-19 Pandemic

The COVID-19 pandemic provided a stark illustration of how fragile supply chains can lead to inflationary pressures. During the initial lockdowns, factory shutdowns and labor shortages resulted in severe disruptions. Simultaneously, an unexpected surge in demand for household goods, electronics, and home improvement materials created unprecedented supply chain imbalances5.

By 2022, supply chain disruptions had transitioned to long-term constraints on productive capacity, driven by a reduced labor force and increased operational costs. The combined effect of these disruptions contributed significantly to the post-pandemic inflation surge6.

Supply Chain Resilience as a Solution to Inflation

Building a resilient supply chain is a strategic approach to mitigating inflationary risks. By adopting proactive measures to enhance flexibility and efficiency, businesses can minimize disruptions and maintain price stability.

Key Strategies for Supply Chain Resilience

- Diversification of Suppliers and Manufacturing Locations:

- Over-reliance on single suppliers or regions increases vulnerability to disruptions. Companies are now adopting nearshoring and reshoring strategies to reduce dependence on distant supply networks.

- Diversifying supplier bases allows businesses to pivot quickly in response to geopolitical, environmental, or economic challenges7.

- Investment in Technology and Automation:

- Advanced technologies such as AI-driven demand forecasting, blockchain for transparency, and automated logistics systems can enhance supply chain efficiency.

- Predictive analytics can help businesses anticipate and address supply chain disruptions before they escalate into major inflationary pressures8.

- Enhanced Inventory Management:

- Implementing just-in-case (JIC) inventory models instead of just-in-time (JIT) can provide buffer stock to counteract supply chain disruptions.

- Strategic stockpiling of critical materials ensures business continuity during supply chain shocks9.

- Stronger Collaboration Between Stakeholders:

- Improved communication and data sharing between suppliers, manufacturers, and retailers lead to better coordination in responding to supply chain risks.

- Collaborative planning can help mitigate disruptions before they translate into inflationary price hikes10.

The Cost-Benefit Analysis of Supply Chain Resilience

While strengthening supply chains reduces inflationary risks in the long run, it also presents short-term challenges. Investing in alternative suppliers, technology upgrades, and additional inventory storage increases operational costs. These expenses may lead to short-term price increases as businesses pass costs onto consumers11.

However, over time, the economic benefits of a resilient supply chain far outweigh the initial investment. Enhanced efficiency, reduced vulnerability to disruptions, and stabilized pricing contribute to long-term economic stability and inflation control12.

Government and Policy Interventions

Recognizing the link between supply chain resilience and inflation control, policymakers are implementing measures to strengthen critical supply networks.

- Incentives for Domestic Manufacturing:

- Federal initiatives such as tax credits and subsidies encourage businesses to invest in domestic production, reducing reliance on foreign suppliers.

- Infrastructure Investments:

- Upgrading ports, highways, and rail systems enhances transportation efficiency and reduces logistical bottlenecks13.

- Trade Policies and Tariff Adjustments:

- Policymakers are reassessing trade agreements to mitigate supply chain vulnerabilities while ensuring fair market competition14.

Conclusion

Inflation remains a complex economic challenge influenced by multiple factors, with supply chain disruptions playing a crucial role in recent price surges. Strengthening supply chain resilience is essential for mitigating inflationary pressures and ensuring economic stability. While investments in diversification, technology, and inventory management may result in short-term cost increases, the long-term benefits outweigh the risks.

By adopting strategic measures and fostering collaboration across industries, businesses and policymakers can create a more resilient supply chain ecosystem—one that safeguards against inflation, enhances productivity, and sustains economic growth in an increasingly uncertain global landscape.

References

- Trading Economics – U.S. Inflation Rate 2025

- The Guardian – U.S. Food Price Inflation Trends

- Reuters – Energy and Inflation Outlook 2025

- National Bureau of Economic Research – Supply Chain Disruptions and Inflation

- Oracle – Supply Chain Inflation Mitigation Strategies

- Richmond Federal Reserve – Economic Brief on Inflation and Supply Chains

- Harvard Business Review – Supply Chain Resilience Strategies

- McKinsey & Company – The Future of Supply Chain Management

- World Economic Forum – The Impact of Supply Chain Technologies

- Deloitte – Managing Inflation Through Supply Chain Resilience

- The Brookings Institution – Economic Stability and Supply Chains

- Federal Reserve Economic Data – Price Stability and Supply Chain Adjustments

- U.S. Department of Transportation – Infrastructure Investments 2025

- The Economist – Trade Policies and Inflation Control

Leave a Reply

Your email address will not be published. Required fields are marked *