Polyethylene and Propylene Production in the US: Market Insights, Trends, and Outlook

The United States remains a key player in global petrochemical production, with polyethylene (PE) and propylene being two of the most critical products in the chemical sector. These materials, essential to countless industries—from packaging to automotive—are produced in large quantities and serve as foundational building blocks in various applications. Understanding the landscape of PE and propylene production in the U.S., the importance of exports, and the evolving market outlook provides insight into one of the most influential sectors in global manufacturing.

Overview of Polyethylene and Propylene

Polyethylene is a versatile polymer widely used in the production of plastic products. It can be categorized into various types, such as high-density polyethylene (HDPE), low-density polyethylene (LDPE), and linear low-density polyethylene (LLDPE). Each of these types serves different industrial applications, ranging from packaging and consumer goods to medical devices.

Propylene, also known as propene, is another critical raw material, primarily used in the production of polypropylene (PP), an essential polymer for automotive parts, textiles, and packaging materials. Propylene is also used in the production of acrylonitrile, a key component in synthetic fibers, and in other chemical processes such as the production of isopropyl alcohol.

Both polyethylene and propylene play significant roles in global supply chains and are critical to meeting the demands of industries ranging from construction to healthcare.

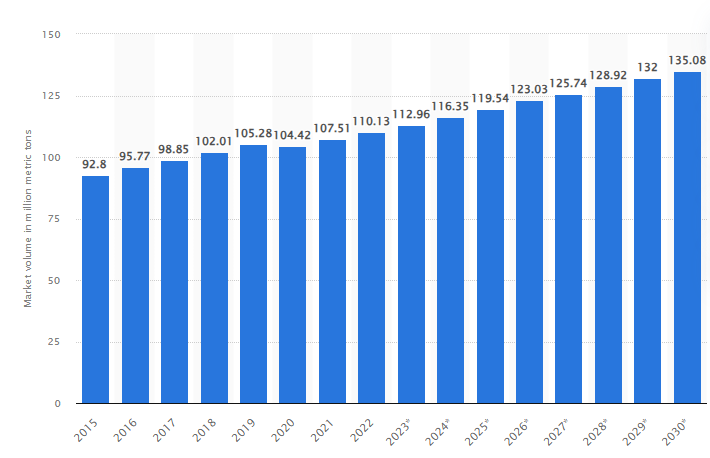

statista.com

U.S. Polyethylene and Propylene Production Capacity

The U.S. has long been a major producer of polyethylene and propylene, with production capacity further boosted by the shale gas revolution and increased availability of low-cost ethane. Ethane, derived from natural gas liquids (NGLs), serves as the primary feedstock for the production of polyethylene, while propylene is produced as a byproduct of refining processes and through propane dehydrogenation (PDH).

Polyethylene Production in the U.S.

As of 2023, the U.S. is home to the largest polyethylene production capacity globally, producing millions of tons annually. U.S. polyethylene producers have benefited from an abundance of affordable natural gas, which has helped reduce feedstock costs and bolster production levels.

Key producers of polyethylene in the U.S. include:

- ExxonMobil: ExxonMobil operates multiple polyethylene plants in the U.S. and is one of the largest producers of polyethylene globally. The company’s Baytown, Texas, facility is one of its flagship plants, producing over 2 million metric tons of polyethylene annually. ExxonMobil focuses on a variety of polyethylene products, including HDPE and LLDPE, which are in high demand in both domestic and international markets.

- Dow Chemical: Dow is another leading U.S. producer of polyethylene, with several plants along the Gulf Coast region. Dow’s polyethylene production capacity exceeds 3.5 million metric tons annually. Dow produces a wide variety of polyethylene, including LLDPE, LDPE, and HDPE, which are primarily used in packaging, films, and consumer products.

- LyondellBasell: LyondellBasell, one of the largest producers of polyethylene in the world, has an extensive footprint in the U.S. with production plants in Texas and Louisiana. The company produces a combined total of approximately 3 million metric tons of polyethylene annually. Their products serve a variety of industries, including packaging, automotive, and consumer goods.

- Chevron Phillips Chemical: Chevron Phillips Chemical is another key player in the U.S. polyethylene market, with facilities along the Gulf Coast. The company has a production capacity of over 2 million metric tons annually, focusing on HDPE, LLDPE, and other specialty polymers used in industries such as packaging, agriculture, and construction.

- Braskem America: A subsidiary of the Brazilian petrochemical giant Braskem, Braskem America produces over 1.5 million metric tons of polyethylene per year. Its production facility in Pennsylvania is one of the key contributors to its U.S. polyethylene output, with a focus on HDPE products used primarily in packaging, household goods, and industrial applications.

- Shell Polymers Monaca: located in Monaca, Pennsylvania, is one of the most significant polyethylene production facilities in the United States. The site, which began production in 2020, has a total annual capacity of 1.6 million metric tons of polyethylene. This plant is part of Shell’s extensive investment in U.S. manufacturing, built to capitalize on the U.S.’s abundant shale gas resources.

Propylene Production in the U.S.

U.S. propylene production is closely tied to the refining and petrochemical industries, with significant quantities produced as a byproduct of refining crude oil and natural gas liquids. The rise in U.S. shale gas production has led to an increase in propylene production through propane dehydrogenation (PDH) technology.

Key U.S. producers of propylene include:

- Shell: Shell operates several PDH plants in the U.S., including one of the world’s largest facilities in Pennsylvania. The company has significantly increased its U.S. production capacity to meet rising demand for propylene derivatives like polypropylene.

- Enterprise Products Partners: A major player in the U.S. petrochemical sector, Enterprise Products is heavily involved in the production of propylene through both refining and PDH processes.

- Valero: As one of the leading refiners in the U.S., Valero’s refineries produce significant quantities of propylene as a byproduct of crude oil refining.

- Reliance Industries: With operations in both refining and petrochemicals, Reliance is another key producer of propylene in the U.S., catering to both domestic and global markets.

Importance of Exports

The U.S. is a significant exporter of polyethylene and propylene, with these materials being shipped to regions across the globe. Polyethylene and polypropylene are essential to a range of industries worldwide, including packaging, automotive, textiles, and construction.

Polyethylene Exports

The U.S. remains one of the leading exporters of polyethylene, primarily due to the abundance of natural gas and the favorable cost structure it provides for polyethylene production. According to data from the American Chemistry Council (ACC), the U.S. exported more than 3.5 million tons of polyethylene in 2022, with the majority of exports heading to Asia, Latin America, and Europe. The Middle East, with its own significant polyethylene production capacity, remains one of the few regions with competitive export opportunities for U.S. producers.

In recent years, the U.S. has seen a sharp rise in polyethylene exports, driven by the expansion of production capacity and the desire to tap into global demand. Emerging markets in Asia, where demand for packaging materials is growing rapidly, are major consumers of U.S. polyethylene.

Propylene Exports

While the U.S. is not as dominant in propylene exports as it is in polyethylene, it is still a significant player in the global market. Propylene is primarily used in the production of polypropylene, and many U.S. propylene producers have focused on increasing their export capabilities. In 2022, the U.S. exported nearly 1.1 million tons of propylene. Propylene exports are largely directed towards North America, Europe, and Asia, with a growing demand in China and India as they ramp up their manufacturing and industrial sectors.

The export of propylene is also essential for supporting the production of polypropylene, which is in demand worldwide due to its applications in automotive parts, packaging, and textiles. As the U.S. focuses on increasing its propylene production through PDH plants and expanding its infrastructure for propylene derivatives, exports are expected to continue to grow.

Market Outlook for Polyethylene and Propylene

The U.S. polyethylene and propylene markets are poised for growth over the next decade, driven by both domestic demand and global consumption. Several key factors are expected to shape the market outlook:

1. Rising Global Demand

As the global economy recovers from the effects of the COVID-19 pandemic, demand for polyethylene and propylene is set to increase. Packaging and consumer goods sectors, in particular, will continue to be major drivers of demand. Additionally, the growing middle class in emerging markets, especially in Asia, will lead to higher demand for plastic products.

2. Technological Advancements

Technological innovations in production processes are expected to drive efficiency and cost-effectiveness in the polyethylene and propylene industries. For example, advancements in catalysts, production processes like PDH, and recycling technologies will help improve yield, reduce waste, and lower the carbon footprint of production.

3. Sustainability Trends

As global consumers and regulators push for greater sustainability, the demand for biodegradable, recyclable, or renewable-based polyethylene and propylene is expected to rise. Companies in the U.S. are increasingly focusing on sustainable practices, which could shift market dynamics toward the production of more eco-friendly plastic alternatives.

4. Competitive Global Market

While the U.S. enjoys a strong position in the global polyethylene market, competition is intensifying from other major producers such as the Middle East, South Korea, and China. These regions have been expanding their production capacity, and the U.S. will need to continue innovating and improving its cost structure to maintain its competitive edge.

Conclusion

Polyethylene and propylene are cornerstone products in the U.S. petrochemical industry. With strong domestic production capacity, a significant export market, and increasing global demand, the U.S. is well-positioned to remain a leading player in the chemicals sector. However, challenges such as increasing competition, sustainability demands, and the need for technological advancements will shape the industry’s future. By leveraging its cost advantages, expanding export opportunities, and focusing on sustainability, the U.S. polyethylene and propylene market is poised for continued growth.

Leave a Reply

Your email address will not be published. Required fields are marked *