The Economic Fallout of Trump’s New Tariff Policy

On February 1, 2025, President Donald Trump declared a national economic emergency, invoking the International Emergency Economic Powers Act (IEEPA) to implement new tariffs on imports from Canada, Mexico, and China. These trade measures include a 25% tariff on all imports from Canada and Mexico, a 10% tariff on imports from China, and an additional 10% tariff on Canadian energy products. These policies have introduced significant changes to global trade, affecting financial markets and multiple industrial sectors.

Immediate Market Reactions

Financial markets responded to the tariff announcement with fluctuations in major currencies. The Mexican peso fell by 2.3% to 21.2 per USD, reaching its lowest point since July 2022. The Canadian dollar depreciated by 1.4%, while the Chinese yuan weakened by 0.7% against the U.S. dollar. Bitcoin also experienced a decline, dropping below $100,000 for the first time in six days. These movements indicate the impact of the tariffs on international trade expectations.

Retaliatory Measures and Global Trade Adjustments

Following the U.S. tariff changes, Canada announced a 25% retaliatory tariff on $155 billion worth of American goods, targeting products such as beer, wine, coffee, apparel, and motorcycles. Mexico is preparing countermeasures, while China plans to file a lawsuit with the World Trade Organization (WTO) and consider restrictions on critical minerals and market access for U.S. firms.

The Economic Exposure of Key Trading Partners

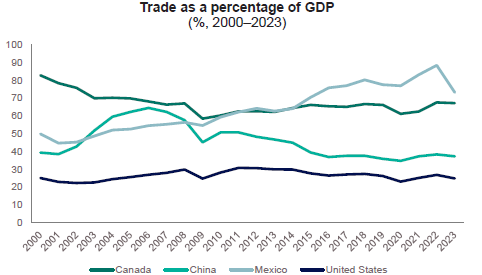

While the United States has a lower dependency on trade compared to many industrialized economies, Canada and Mexico rely heavily on trade with the U.S. Canada sends over 75% of its exports to the U.S., while Mexico’s economy is significantly tied to its exports, 80% of which are sent to the U.S. This makes these economies particularly affected by the tariff adjustments.

China, on the other hand, has diversified its export markets, reducing its exposure to U.S. trade policies. The country has expanded its trade partnerships with the European Union, Mexico, and Vietnam, which may mitigate some of the impact of the tariffs. However, sectors such as electronics, pharmaceuticals, and chemicals that rely on Chinese imports may see increased costs in the U.S.

Sector-Specific Impacts

Manufacturing and Automotive Industry

The U.S. automotive sector, which imports key components from Canada and Mexico, is expected to see increased production costs. With approximately 5.3 million vehicles produced annually in these two countries—70% of which are exported to the U.S.—tariffs on propulsion systems, engines, and steel imports will impact automakers such as Ford, General Motors, Toyota, and Stellantis. The price of U.S.-built vehicles could rise by up to $3,000 per unit.

Energy and Raw Materials

The energy sector will also be affected, as the U.S. imports about 40% of its crude oil, with Canada being the largest supplier. A 10% tariff on Canadian oil could contribute to higher fuel and electricity costs. Additionally, tariffs on steel and aluminum imports may increase costs in construction, heavy machinery, and industrial production.

Chemicals, Hydrocarbons, and Polymers

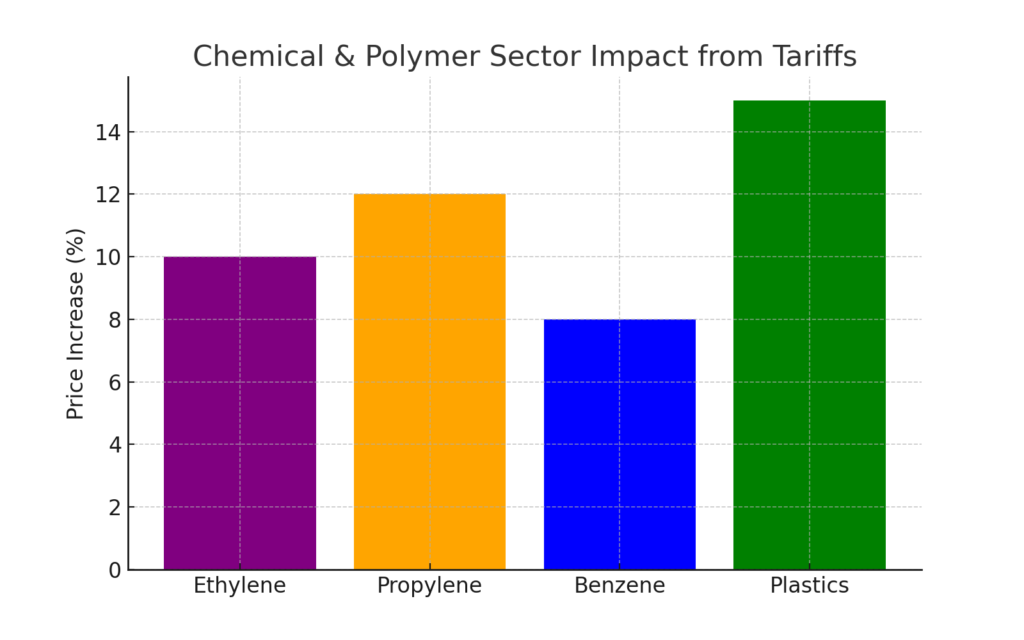

The chemical and oil & gas sectors are expected to face increased costs due to tariffs on raw materials and energy products. Many petrochemicals, including ethylene, propylene, and benzene, serve as key feedstocks for the plastics and polymer industries. Increased costs of these base chemicals could impact multiple downstream industries, including packaging, automotive, and consumer goods manufacturing.

The U.S. imports significant quantities of refined hydrocarbons and specialty chemicals from Canada and Mexico, and the added tariffs could lead to price increases in industrial applications, pharmaceuticals, and coatings. Companies reliant on these raw materials may need to explore alternative supply chains or absorb higher costs, potentially affecting competitiveness in global markets.

Consumer Goods and Food Prices

The agricultural sector is another area where the effects of tariffs will be felt. The U.S. imports large quantities of fruits, vegetables, grains, and meat from Mexico and Canada. A 25% tariff on these imports is expected to contribute to higher food prices for American consumers. Mexico supplies over 80% of avocados and a significant portion of vegetables and fruits to the U.S., making grocery costs susceptible to increases.

Long-Term Economic Considerations

The tariffs may have implications for the United States-Mexico-Canada Agreement (USMCA), which was designed to promote free trade across North America. Higher production costs and supply chain disruptions may discourage investment, slow economic growth, and push businesses to explore alternative manufacturing locations. Additionally, retaliatory tariffs from Canada and Mexico may impact U.S. exports.

On a broader scale, global trade relationships could shift as countries seek to reduce reliance on the U.S. market. China, Mexico, and Canada may look to strengthen ties with emerging markets and other trading partners in response to these policy changes.

Conclusion

The newly implemented tariff measures have introduced adjustments to global trade, affecting multiple sectors and financial markets. While the policy aims to address specific economic concerns, businesses and industries must adapt to rising costs, supply chain shifts, and potential changes in international trade agreements. Moving forward, the economic impact will depend on how businesses and trading partners respond to these changes and whether further policy adjustments are introduced.

Leave a Reply

Your email address will not be published. Required fields are marked *